分享兴趣,传播快乐,增长见闻,留下美好。

亲爱的您,这里是LearningYard学苑!

今天小编为大家带来【偏好信息不完全时的不确定决策】一文的扩展和结论部分。

欢迎您的访问!

Share interest, spread happiness, increase knowledge, and leave beautiful.

Dear, this is the LearingYard Academy!

Today, the editor brings the extensions and conclusion of the article "Decision making under uncertainty when preference information is incomplete".

Welcome to visit!

1 内容摘要(Content summary)

今天小编将从「思维导图、精读内容、知识补充」三个板块,解读分享【偏好信息不完全时的不确定决策】一文的扩展和结论部分。

Today, the editor will interpret and share the extensions and conclusion of the article "Decision making under uncertainty when preference information is incomplete" from the three ps of "mind map, intensive reading content, and knowledge supplement".

2 思维导图(Mind mapping)

3 精读内容(Intensive reading content)

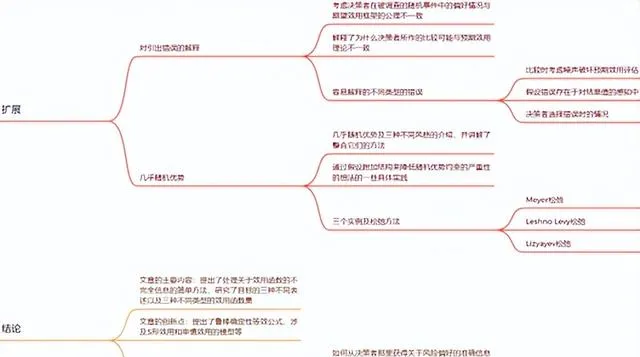

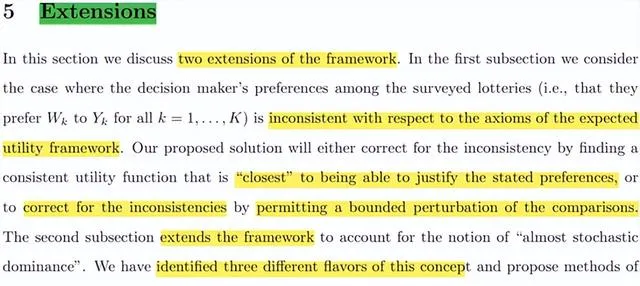

文章的第五节为扩展部分,在这一节作者讨论了前文中框架的两个扩展。第一个扩展为考虑决策者在被调查的随机事件中的偏好情况与期望效用框架的公理不一致。第二个扩展为几乎随机优势及三种不同风格的介绍,并讲解了整合它们的方法。

The fifth p of the article is the extension part. In this p, the author discusses two extensions of the previous framework. The first extension is to consider situations where the decision maker's preferences in the random event under investigation are inconsistent with the axioms of the expected utility framework. The second expansion is an introduction to the advantages of almost randomness and three different styles, and explains how to integrate them.

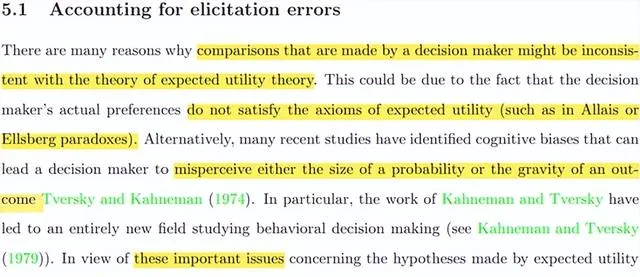

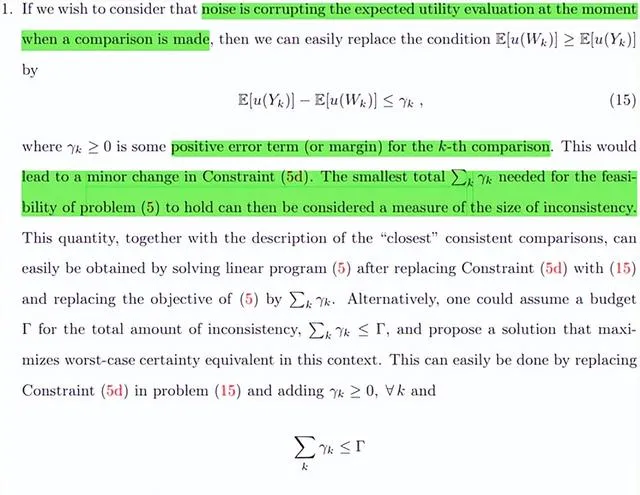

第一个扩展为对引出错误的解释,解释了为什么决策者所作的比较可能与预期效用理论不一致,可能因为决策者的实际偏好不满足预期效用公理。作者给出的方法框架可以识别并对这些不一致进行处理。

The first extends to an explanation of elicitation errors, explaining why comparisons made by the decision-maker may be inconsistent with expected utility theory, perhaps because the decision-maker's actual preferences do not satisfy the expected utility axiom. The methodological framework presented by the authors can identify and deal with these inconsistencies.

后续作者描述了三种容易解释的不同类型的错误,分别是比较时考虑噪声破坏预期效用评估、假设错误存在于对结果值的感知中和决策者选择错误时的情况。

Subsequent authors describe three different types of errors that are easily explained, namely when accounting for noise in comparisons corrupts expected utility assessments, when assumptions error resides in the perception of outcome values, and when decision makers make wrong choices.

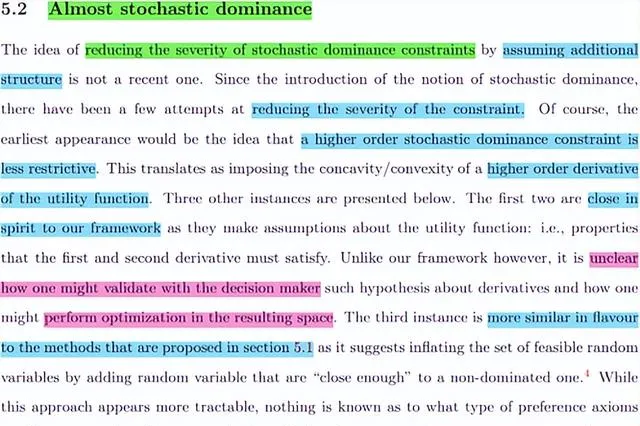

第二个扩展为几乎随机优势,讲了通过假设附加结构来降低随机优势约束的严重性的想法的一些具体实践,分为三个实例,前两个对效用函数做了假设,与本文框架较为接近,第三个与第一节中的方法较为接近。作者提出了扩展结果以分别实现这三种情况中所提议的松弛的方法,分别为Meyer松弛、Leshno Levy松弛和Lizyayev松弛。

The second extension, Almost Random Advantage, talks about some concrete practice of the idea of reducing the severity of the stochastic advantage constraint by assuming additional structure. It is divided into three examples. The first two make assumptions about the utility function and are closer to the framework of this article. The third one is closer to the method in the first p. The authors propose methods to extend the results to implement the proposed relaxations in these three cases, respectively Meyer relaxation, Leshno Levy relaxation and Lizyayev relaxation.

结论部分,作者总结了文章的主要内容,即提出了处理关于效用函数的不完全信息的简单方法,研究了目标的三种不同表述以及三种不同类型的效用函数集。文章还有很多创新点,如提出了鲁棒确定性等效公式、涉及S形效用和审慎效用的模型等。

In the conclusion part, the author summarizes the main content of the article, that is, a simple method for processing incomplete information about utility functions is proposed, and three different formulations of goals and three different types of utility function sets are studied. The article also has many innovative points, such as proposing a robust deterministic equivalent formula, a model involving S-shaped utility and prudent utility, etc.

文章所提出的框架为后续的进一步研究留下了很多空间,比如如何从决策者那里获得有关风险偏好的准确信息等。

The framework proposed in the article leaves a lot of room for further research, such as how to obtain accurate information about risk preferences from decision makers.

4 知识补充(Knowledge supplement)

什么是预期效用假说?

What is the expected utility hypothesis?

预期效用假说认为微观经济学、博弈论、决策论中,在风险情况下,个人所做出的选择是追求某一数量的预期价值的最大化,该假说用于解释保险中的期望值。

The expected utility hypothesis holds that in microeconomics, game theory, and decision theory, under risk situations, the choice an individual makes is to pursue the maximization of a certain amount of expected value. This hypothesis is used to explain the expected value in insurance.

关于风险行为的预期效用假说,它本质上假设单个决策者拥有定义在某些结果集合上的冯诺依曼摩根斯顿效用函数或冯诺依曼摩根斯顿效用指数。当单个决策者面临关于这些结果的各种可选择预期时,他将选择使预期值最大的预期。

Regarding the expected utility hypothesis of risky behavior, it essentially assumes that a single decision maker has a von Neumann Morgenstern utility function or a von Neumann Morgenstern utility index defined on some set of outcomes. When an individual decision maker is faced with alternative expectations about these outcomes, he will choose the expectation that maximizes the expected value.

由于结果可以表示为财富水平、多维商品集、消费的时间流量或非数字结果,故这个理论可用于多方面,例如不确定性经济学的理论研究,不确定条件下最优贸易、投资等应用研究。

Since outcomes can be expressed as wealth levels, multidimensional sets of goods, time flows of consumption, or non-numerical outcomes, this theory can be used in many ways. For example, theoretical research on uncertainty economics and applied research on optimal trade and investment under uncertain conditions.

今天的分享就到这里了。

如果您对今天的文章有独特的想法,

欢迎给我们留言,

让我们相约明天,

祝您今天过得开心快乐!

That's all for today's sharing.

If you have a unique idea about the article,

please leave us a message,

and let us meet tomorrow.

I wish you a nice day!

参考资料:

翻译:Google翻译

文字:

预期效用假说 - MBA智库百科 (mbalib.com)

参考文献:

Benjamin Armbruster, Erick Delage. Decision making under uncertainty when preference information is incomplete [J]. Management science, 2015, 61(1): 111-128.

版权说明:

本文由LearningYard学苑整理并发出,如有侵权请后台留言沟通。

文案I姜疯雨火

排版I姜疯雨火

审核IGoldfish