分享興趣,傳播快樂,

增長見聞,留下美好。

親愛的您,這裏是LearningYard學苑!

今天小編為大家帶來「越覽(57):精讀期刊論文

【基於前景理論和內容相關的機率語言 SIR 多內容

群決策方法及套用】的

2.機率語言術語集與前景理論(2)」。

歡迎您的存取!

Share interest, spread happiness,

increase knowledge,and leave beautiful.

Dear, this is LearningYard Academy!

Today, the editor brings you the

" Yue Lan (57):Intensive reading of the journal article

'Multi-attribute group decision making method

and its application based on

prospect theory and attribute-related probabilistic

language SIR: 2. Probability language terminology

set and prospect theory (2) '".

Welcome to visit!

一、內容摘要(Summary of content)

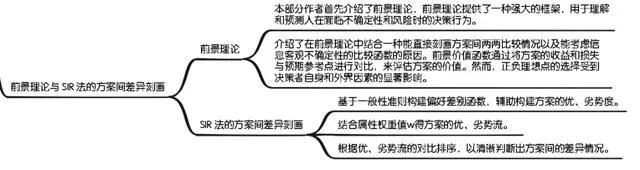

本期推文將從思維導圖、精讀內容、知識補充三個方面介紹期刊論文【基於前景理論和內容相關的機率語言 SIR 多內容群決策方法及套用】的機率語言術語集與前景理論 (2):前景理論與 SIR 法的方案間差異刻畫。

This tweet will introduce the Probability Language Terminology Set and Prospect Theory (2): Difference between prospect theory and SIR method of the journal paper "Multi-attribute group decision making method and its application based on prospect theory and attribute-related probabilistic language SIR" from three aspects: mind mapping, intensive reading content, and knowledge supplementation.

二、思維導圖(Mind mapping)

三、精讀內容(Intensive reading content)

(一)前景理論(Prospect theory)

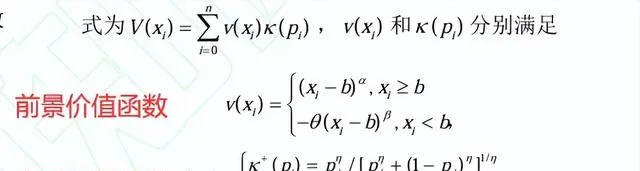

本部份作者首先介紹了前景理論,前景理論提供了一種強大的框架,用於理解和預測人在面臨不確定性和風險時的決策行為。在本文中,前景理論是由前景價值函式和心理權重函陣列成的綜合前景值來刻畫方案間的差異,具體形公式如下所示:

The author of this part first introduces prospect theory, which provides a powerful framework for understanding and predicting human decision-making behavior in the face of uncertainty and risk. In this paper, prospect theory is a comprehensive prospect value composed of prospect value function and psychological weight function to describe the differences between schemes. The specific formula is as follows:

接著作者介紹了在前景理論中結合一種能直接刻畫方案間兩兩比較情況以及能考慮資訊客觀不確定性的比較函式的原因。前景價值函式透過將方案的收益和損失與預期參考點進行對比,來評估方案的價值。然而,正負理想點的選擇受到決策者自身和外界因素的顯著影響。現有的研究在使用前景價值函式時,並不是直接將方案進行兩兩對比,而是更多地依賴於單個方案與參考點的對比。

Then the author introduces the reasons for combining a comparison function in prospect theory that can directly describe the pair comparison between schemes and take into account the objective uncertainty of the information. The prospect value function evaluates the value of the scheme by comparing the benefits and losses of the scheme with the expected reference point. However, the choice of positive and negative ideal points is significantly influenced by the decision maker's own and external factors. Existing studies do not directly compare the scheme in pairs when using the prospect value function, but rely more on the comparison of individual schemes with reference points.

此外,心理權重函式反映了決策者對方案收益和損失出現機率的主觀判斷,但決策環境的不確定性還包括資訊的客觀不確定性。因此,為了更符合現實的決策情況,前景理論需要結合一種能直接刻畫方案間兩兩比較情況的函式,並且能夠考慮資訊的客觀不確定性。這樣的改進可以使前景理論在多內容群決策中更加實用和準確。

In addition, the psychological weight function reflects the subjective judgment of the decision-maker on the probability of the benefit and loss of the scheme, but the uncertainty of the decision-making environment also includes the objective uncertainty of the information. Therefore, in order to be more in line with the realistic decision-making situation, the prospect theory needs to be combined with a function that can directly describe the two-pair comparison between the schemes, and can take into account the objective uncertainty of the information. Such an improvement can make the prospect theory more practical and accurate in multi-attribute group decision-making.

(二)SIR 法的方案間差異刻畫(Difference characterization of SIR method between schemes)

作者介紹了刻畫方案間兩兩差異的排序法中,部份研究采用的經典SIR法的三個步驟。

The author introduces the three steps of the classical SIR method used in some studies to characterize the differences between schemes.

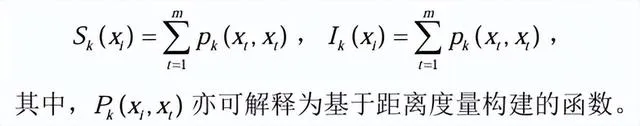

首先,基於一般性準則構建偏好差別函式,輔助構建方案的優、劣勢度:

First, the preference difference function is constructed based on general criteria to assist in building the advantages and disadvantages of the scheme:

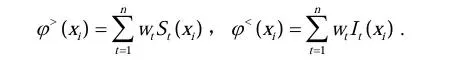

其次,結合內容權重值w得方案的優、劣勢流:

Secondly, the advantages and disadvantages of the scheme are obtained by combining the attribute weight value w:

最後,根據優、劣勢流的對比排序,以清晰判斷出方案間的差異情況。

Finally, according to the comparative ranking of advantages and disadvantages, the differences between the schemes can be clearly judged.

然而,該過程還應考慮決策者的心理行為因素。例如:當決策者發現某個方案有確定收益時,會傾向於選擇該方案,表現出「風險規避」。當某個方案的確定損失很小,而其他方案的收益、損失情況未知時,決策者可能願意冒險選擇其他方案,表現出「風險喜好」。

However, the process should also take into account the decision-maker's psychological and behavioral factors. For example, when decision-makers find that a certain plan has certain benefits, they will tend to choose that plan, showing "risk aversion". When the determined losses of one plan are small, and the benefits and losses of other plans are unknown, decision-makers may be willing to take risks and choose other options, showing "risk appetite".

這些現象描述了決策者在不同風險偏好下的方案選擇情況,但現有研究尚未廣泛將此類情形拓展到經典SIR法中。大多數研究僅利用簡單的對比函式來刻畫方案間的差異,未能充分展示風險偏好對經典SIR法排序規則的影響。因此,本文將前景理論與經典SIR法相結合, 既能夠以主客觀綜合性角度刻畫方案間的差異,又能 夠拓展前景理論和經典SIR法在決策環境中的套用。

These phenomena describe decision-makers' choice of options under different risk preferences, but existing studies have not widely extended such scenarios to classical SIR methods. Most studies only use simple contrast functions to describe the differences between options, failing to fully demonstrate the impact of risk preferences on the ranking rules of classical SIR methods. Therefore, this paper combines prospect theory with classical SIR method, which can not only describe the differences between options from a subjective and objective comprehensive perspective, but also expand the application of prospect theory and classical SIR method in decision-making environments.

四、知識補充(Knowledge supplement)

1. 前景價值函式(Foreground value function)

想象你在做決定時,會把現在的狀況作為一個「參考點」。比如,如果你現在有100元,那麽100元就是你的參考點。當你面對一個可能賺100元或虧100元的選擇時,你會把這個選擇與100元這個參考點進行對比。

Imagine your current situation as a "reference point" when making a decision. For example, if you have $100 now, then $100 is your reference point. When you are faced with a choice that could make $100 or lose $100, you compare that choice to the reference point of $100.

收益:如果賺100元,你就會覺得很開心,因為你的財富從100元增加到了200元。

Income: If you earn 100 yuan, you will feel very happy because your wealth has increased from 100 yuan to 200 yuan.

損失:如果虧100元,你可能會覺得非常不開心,因為你的財富從100元減少到了0元。

Loss: If you lose 100 yuan, you may feel very unhappy because your wealth has been reduced from 100 yuan to 0 yuan.

這裏的關鍵是,人們對損失的敏感度通常比對收益的敏感度更高。也就是說,失去100元帶來的痛苦比獲得100元帶來的快樂更強烈。

The crux of the matter here is that people tend to be more sensitive to losses than to gains, meaning that the pain of losing $100 is more intense than the pleasure of gaining $100.

2. 正負理想點(Positive and negative ideal point)

在實際決策中,參考點可以進一步細分為「正理想點」和「負理想點」:

In practical decision-making, reference points can be further subdivided into "positive ideal points" and "negative ideal points":

正理想點:是你希望達到的最佳狀態。比如,你希望自己的財富達到500元。

The ideal point: is the best state you want to achieve. For example, you want your wealth to reach 500 yuan.

負理想點:是你最不願意接受的最壞狀態。比如,你最不願意自己的財富降到0元。

Negative ideal point: is the worst state you are least willing to accept. For example, you are least willing to drop your wealth to 0 yuan.

這些理想點的選擇受到很多因素的影響,包括你的個人經歷、社會環境、文化背景等。

The choice of these ideal points is influenced by many factors, including your personal experience, social environment, and cultural background.

3. 心理權重函式(Psychological weight function)

心理權重函式描述了你對某個事件發生機率的主觀感受。舉個例子:

A mental weight function describes your subjective feeling about the probability of an event occurring. For example:

如果你被告知有1%的機率贏得1000元,你可能會覺得這個機率很低,幾乎不可能發生。但如果有人告訴你有99%的機率贏得1000元,你可能會覺得這個機率非常高,幾乎肯定會發生。但實際上,1%和99%的機率並不是完全被忽視或完全信任的。人們往往會高估小機率事件,低估大機率事件。

If you are told that there is a 1% chance of winning $1,000, you may think that the probability is very low and almost impossible to happen. But if someone tells you that there is a 99% chance of winning $1,000, you may think that the probability is very high and almost certain to happen. But in reality, 1% and 99% probabilities are not completely ignored or completely trusted. People tend to overestimate small probability events and underestimate high probability events.

今天的分享就到這裏了。

如果您對文章有獨特的想法,

歡迎給我們留言,讓我們相約明天。

祝您今天過得開心快樂!

That's all for today's sharing.

If you have a unique idea about the article,

please leave us a message,

and let us meet tomorrow.

I wish you a nice day!

文案|yyz

排版|yyz

稽核|hzy

轉譯:火山轉譯

參考資料:百度百科、通義千問

參考文獻:於文玉. 基於多粒度猶豫模糊語言資訊的多內容群決策方法研究 [D]. 大連理工大學, 2021.

本文由LearningYard學苑整理發出,如有侵權請在後台留言!